EU eases state resource rules in multi-billion euro improve for chip zone

By Er Kamalanathan j

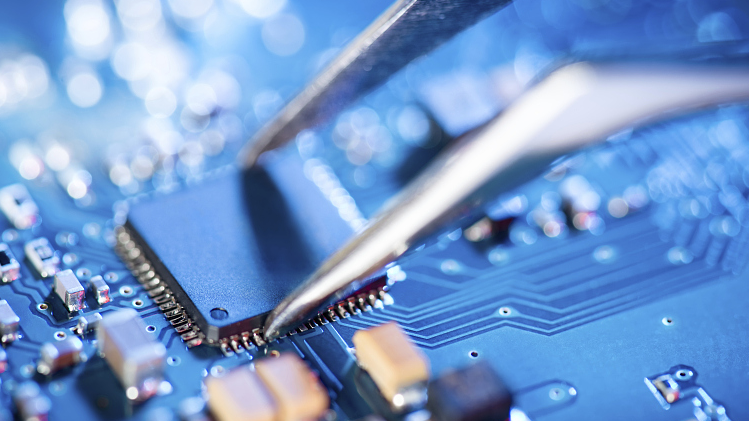

BRUSSELS, Feb 8 (Reuters) - The European Commission will ease investment regulations for innovative semiconductor plant life below plans introduced on Tuesday because the European Union looks to boost its chip industry and cut its dependence on U.S. And Asian deliver.

The Commission's motion comes as a worldwide chip shortage and deliver chain bottlenecks have created havoc for vehicle makers, healthcare vendors, telecoms operators and others.

The European Chips Act will "enable 15 billion euros ($17 billion) in additional public and private investment with the aid of 2030," Commission President Ursula von der Leyen stated in a announcement.

"This will come on top of 30 billion euros of public investments already planned from NextGenerationEU, Horizon Europe and national budgets. And these budget are set to be matched by way of similarly long-term private investments," she stated, relating to ongoing EU tasks.

The EU pass mirrors the $52 billion U.S. Chips Act geared toward growing competitiveness with China.

Von der Leyen stated the bloc will ease its kingdom resource guidelines, which goal to prevent illegal and unfair subsidies granted by means of EU international locations to companies, for progressive chip factories.

"We are, consequently, adapting our nation useful resource regulations, under strict conditions. This will allow - for the primary time – public support for European 'first-of-a-type' manufacturing facilities, which benefit all of Europe."

These factories can be allowed to get extra state investment, EU digital chief Margrethe Vestager said, because the bloc seeks to double its worldwide market proportion to twenty% in 2030.

"Such facilities, they could not exist in Europe if we do now not do something. It can be justified to cover up to one hundred% of the validated funding gap with public assets," she advised a information conference.

Vestager, requested if the Commission became bending kingdom useful resource guidelines, stated investment approval might be primarily based on a hardly ever used provision inside the EU treaty and that resource needed to be proportionate, have a pan-European effect and not be more than changed into essential.

She additionally warned EU governments against unfair strategies to draw investments.

"Because we can not simply authorise any subsidy wherein one is better than the alternative. We have continually been form of very responsive to the fact that it need to not be for one authorities to try and lure investments in a single territory by using jacking up the nation useful resource promises," she said.

Smaller EU nations have voiced their unease over the looser rules, fearing a subsidy race with the intention to favour companies within the bigger countries together with France, Germany, the Netherlands and Italy, an EU diplomat stated.

The chip push comes as EU nations woo U.S. Chipmaker Intel , which has yet to announce in which it'll find a European mega-fab plant, triggering concerns of a subsidy race.

Intel welcomed the EU chip push, urging authorities on each aspects of the Atlantic to sign up for forces.

"We are currently thinking about a full-size boom in our European footprint, and we count on that the EU Chips Act will facilitate these plans," the company said in a assertion.

Britain's Arm Ltd, which named a brand new CEO on Tuesday, stated it would cross public earlier than March 2023 and Masayoshi Son, boss of discern firm SoftBank, indicated that could be in the United States, most likely the Nasdaq. Read extra

The IPO plans comes as SoftBank dropped plans to promote Arm to U.S. Chipmaker Nvidia Corp (NVDA.O), putting apart a deal doubtlessly well worth as much as $eighty billion because of regulatory hurdles.

Global Wafers is also looking for a new greenfield web page as part of a $3.6 billion growth plan put in region after its failed takeover of Germany's Siltronic.

The European Chips Act, whichwill require approval from EU countries and EU lawmakers earlier than it may emerge as law, also includes a toolbox permitting the Commission to demand companies deliver key chips in the course of a crisis.

($1 = 0.8763 euros)

(PrimeXBT Special Offer: Use this link to register & enter POTATO50 code to receive up to $7,000 on your deposits.)

You Might Also Like:

0 comments:

Post a Comment

Thank you for watching, this is for network marketing