As 10,000 Long-Dormant Bitcoins Finally Trade, Observers Wonder What's Up

Blockchain data indicates 10,000 BTC, really worth extra than $two hundred million, have been moved in transactions inside the remaining week.

By Er KamalanathanJ

Unusual blockchain statistics seems to reveal massive blocks of bitcoin worth more than $200 million transferring for the primary time in years, prompting crypto analysts to scratch their heads and be anxious over what to make of it – if anything at all.

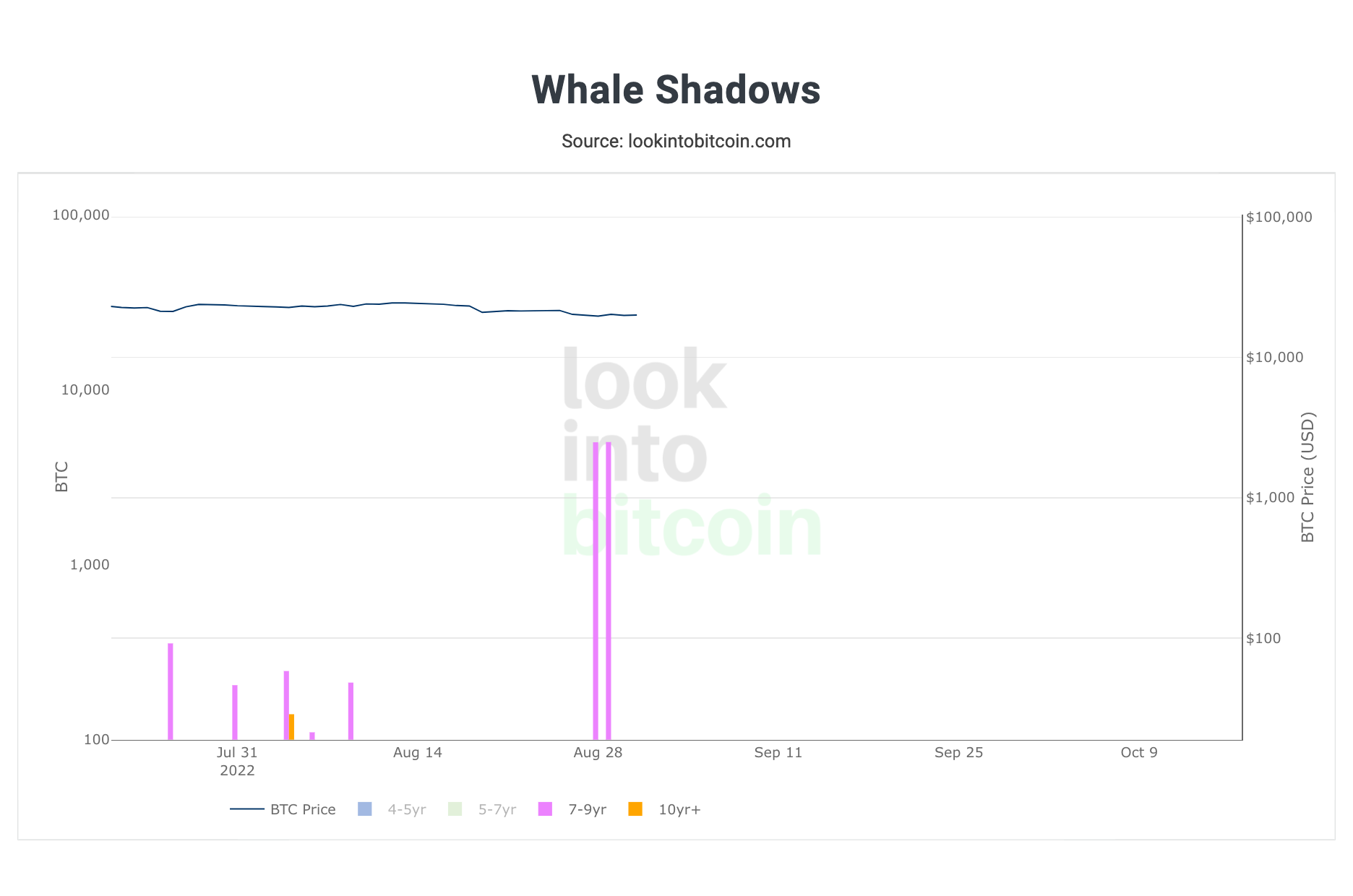

On Aug. 28, according to a submit from crypto records evaluation platform CryptoQuant, 5,000 BTC that hadn’t moved for at the least seven years changed into transacted.

The next day, LookIntoBitcoin’s data tracker confirmed another five,000 BTC was transferred again.

Analysts say the transaction statistics isn't always enough to draw any fundamental conclusions and there’s no difficult evidence about why the cash were moved. It’s possible that a long-time period holder is looking to get out of the market, regardless of bitcoin fees at round $20,000, that is well off their all-time excessive of nearly $69,000. Or it might simply be that the holder is truly making some administrative changes to the account popularity.

It’s lengthy been a chunk of a spectator sport in crypto to watch long-dormant bitcoin circulate. In May 2020, the marketplace became in brief rattled by speculation that Bitcoin founder Satoshi Nakamoto is probably shifting around a small batch of the cryptocurrency. Wallets tagged to Nakamoto – who has in no way been conclusively diagnosed – are closely watched with the aid of crypto analysts. His hoard is so outstanding that if it wee liquidated, the rate of bitcoin would drop.

This isn’t the primary time this 12 months that large lengthy-dormant BTC transactions have been spotted.

The CryptoQuant put up stated extra than 10,000 BTC turned into moved while the BTC rate turned into at $47,700 in March, 2,800 BTC moved in May, and extra than 1,one hundred BTC changed into moved at $23,000 per coin in July.

“The broader trend amongst addresses retaining among 1,000 and 10,000 BTC has been to boom their holdings during the last month, with their mixture stability mountaineering by 35,000 BTC,” Lucas Outumuro, head of studies at IntoTheBlock, told CoinDesk.

Bitcoin's price

Theoretically, maintaining coins in different wallets may assist buyers manage their holdings greater efficaciously in times of high marketplace volatility, and industry experts stated it didn’t seem too unusual for wallets of this age to transport.

"We frequently see early bitcoin wallets like this turning into lively," Kim Grauer, director of research at Chainalysis, advised CoinDesk in an email.

It could also be that the bitcoin market has matured to the factor wherein major macroeconomic tendencies, like Federal Reserve price hikes, inflation reports or the August jobs report might have a greater impact on bitcoin's rate than a pair of isolated and unexplained facts factors.

IntoTheBlock’s Outumuro stated the bitcoin data is probably “secondary in comparison to macro correlations close to time period, as there is much less liquidity inside the machine.”

For what it’s really worth, the current coin transfers took place quickly after Federal Reserve Chairman Jerome Powell said last week that the critical bank could in all likelihood preserve an competitive campaign to tamp down soaring inflation – a stance that during flip might preserve downward strain on prices for unstable belongings, from stocks to cryptocurrencies.

BTC’s price dipped under $20,000 following Powell’s speech. It turned into lately trading at about $20,300.

:format(webp)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/UP7FOFJU4VATHPLFQ36OPVMAOU)

0 comments:

Post a Comment

Thank you for watching, this is for network marketing